‘Failing the Fix’ scorecard grades Apple, Samsung, Google, others on how fixable their devices are

Grading laptop and cell phone companies on the fixability of their products

Nobody walks into an electronics store and thinks, “I’m going to buy something that breaks.” Our scorecard helps you choose a repairable phone or laptop from a brand which supports your Right to Repair.

Download Full Report

Many phones and laptops on the market are made to be so difficult to fix they become essentially disposable. We want to choose electronics that are durable and fixable, but how do we know which products are designed to last and which are destined for the dump?

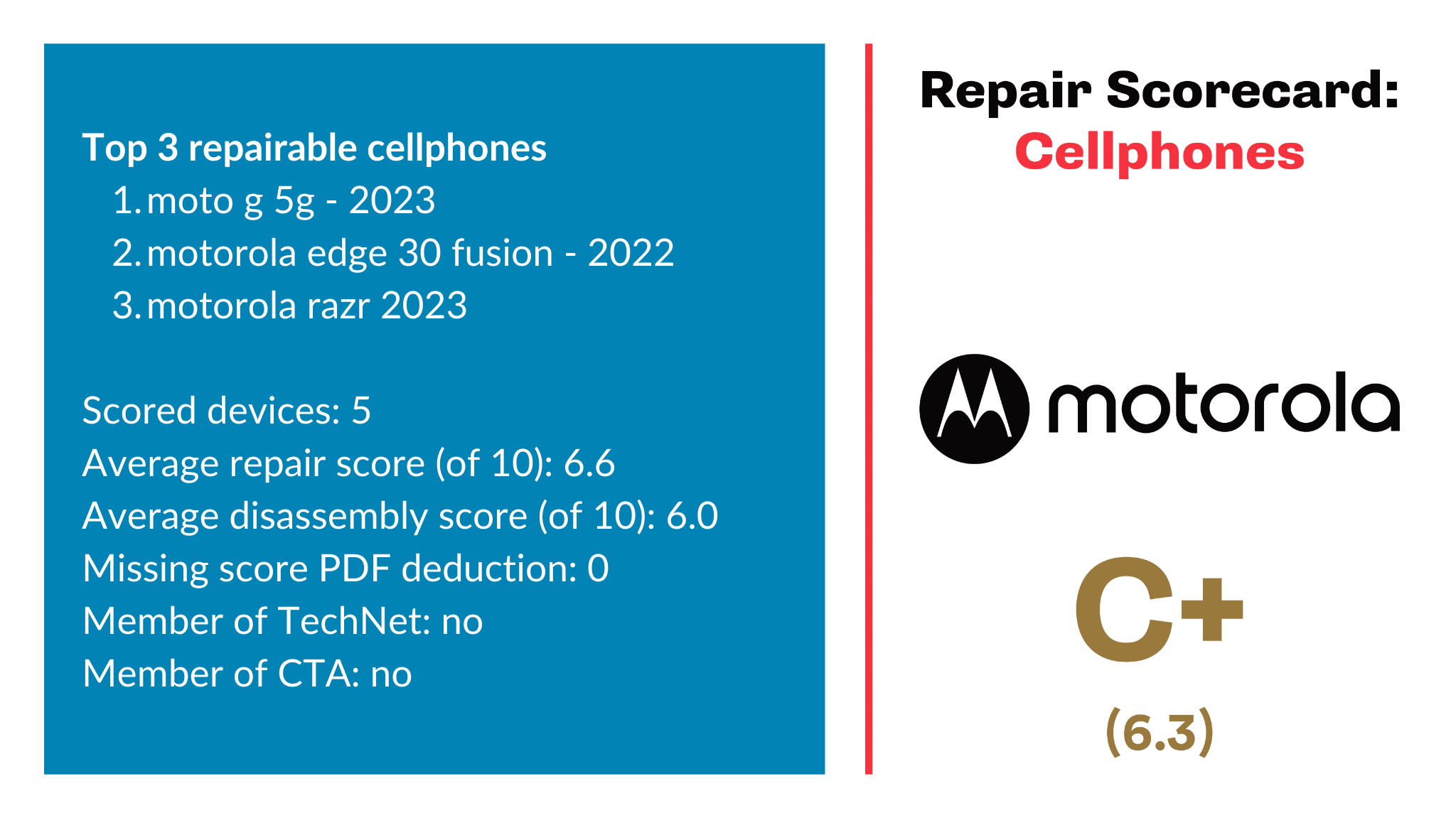

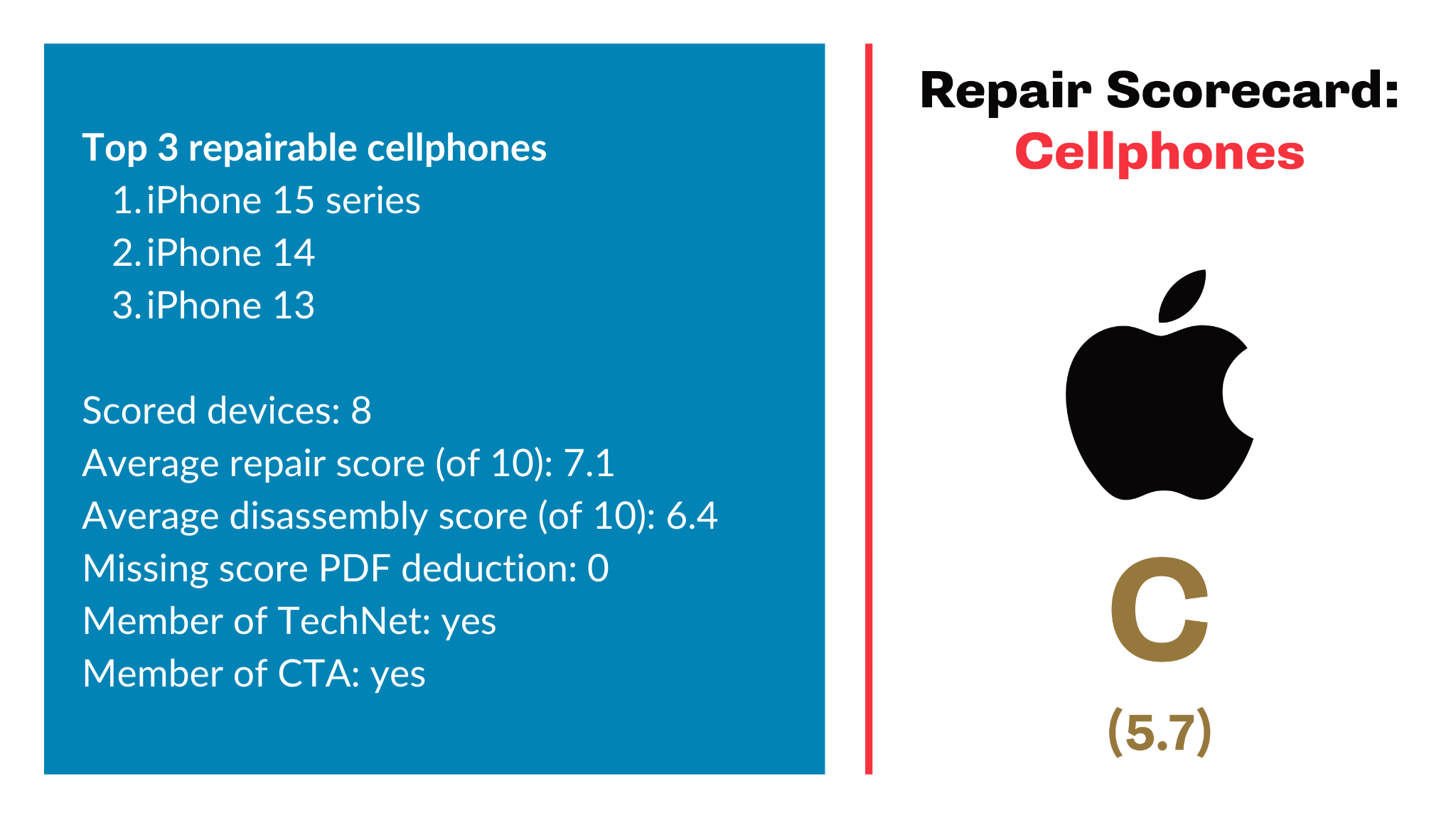

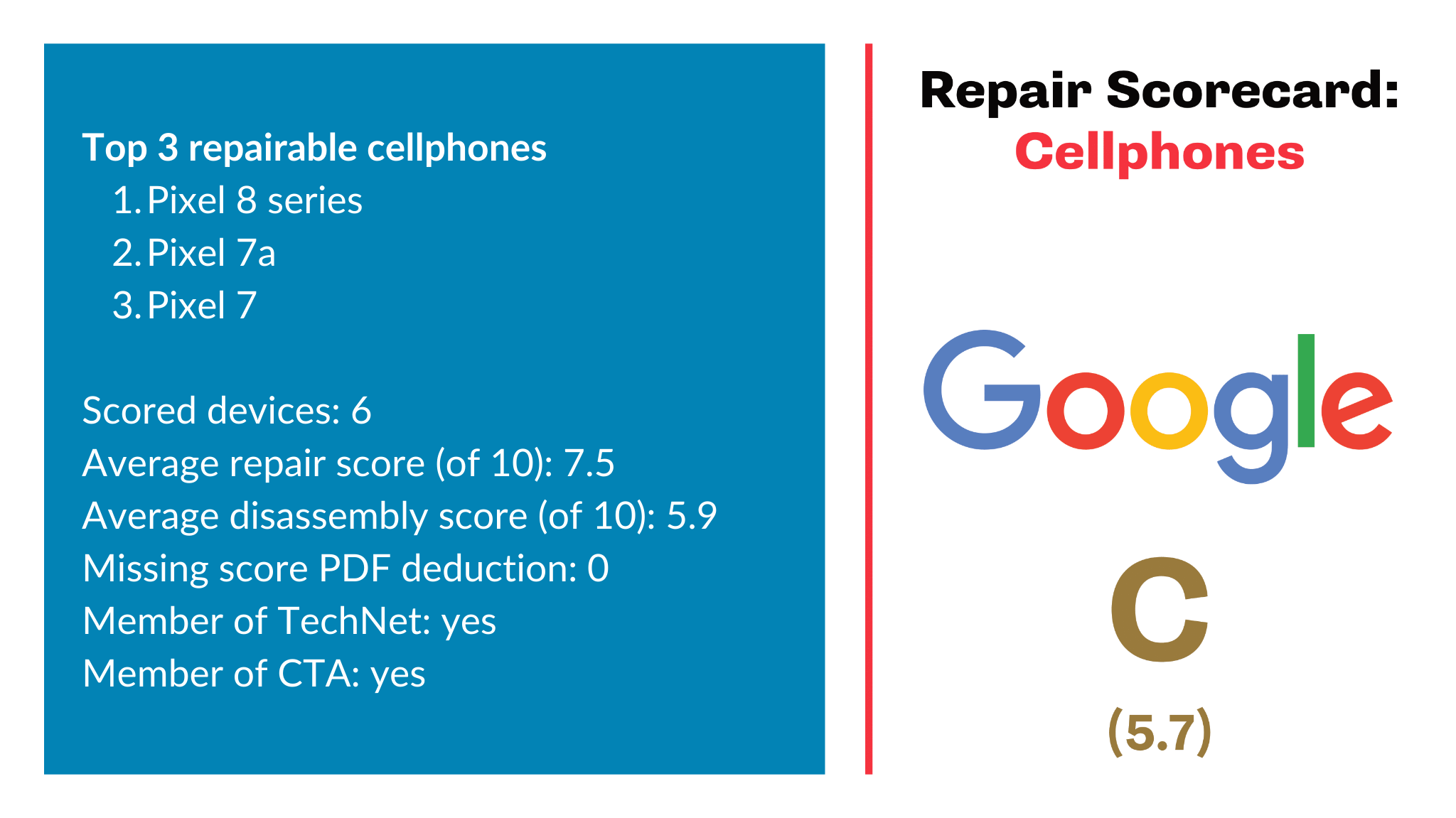

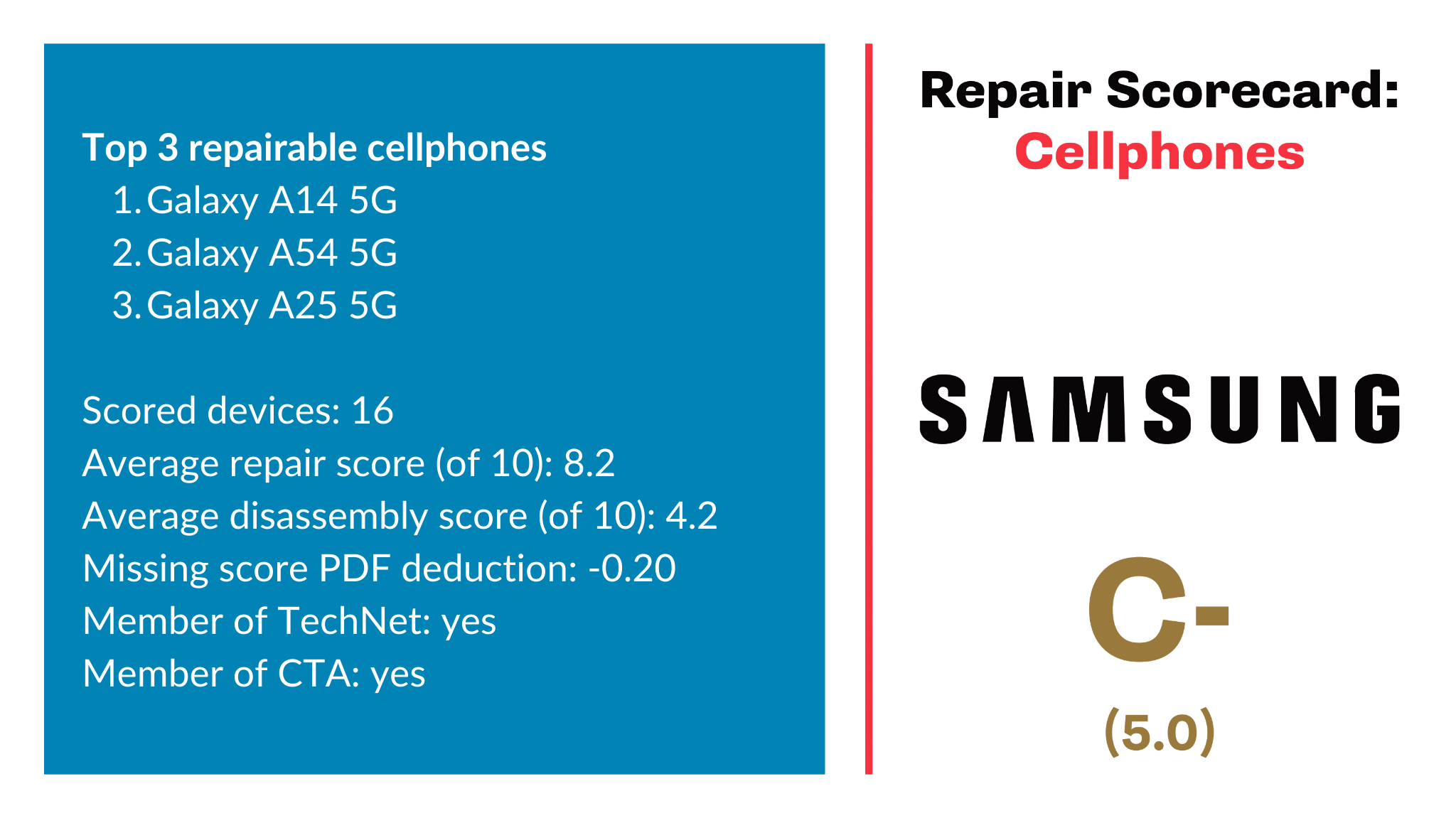

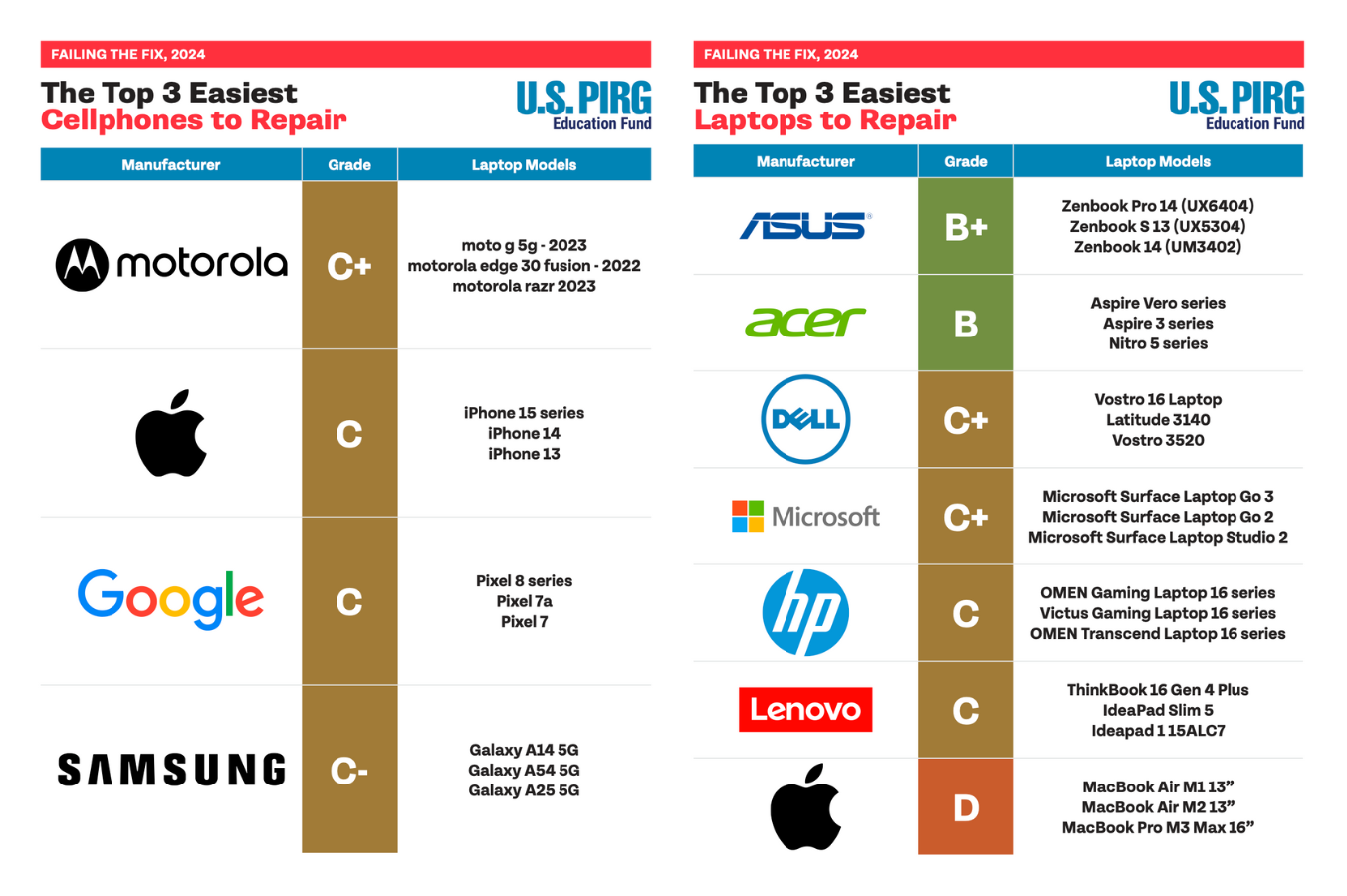

This report calculates a repairability score for the most popular cell phone and laptop brands, and grades which manufacturers are designing devices to last and which are “Failing the Fix.” This year’s scorecard includes a section highlighting the three most repairable cell phones and laptops available on the market from each manufacturer to help you buy a fixable device.

Failing the Fix scorecard grades manufactures how the repairability of their phones and laptops. Click to enlarge.Photo by Alec Meltzer | TPIN

What did we find?

- More cellphones are designed to last.

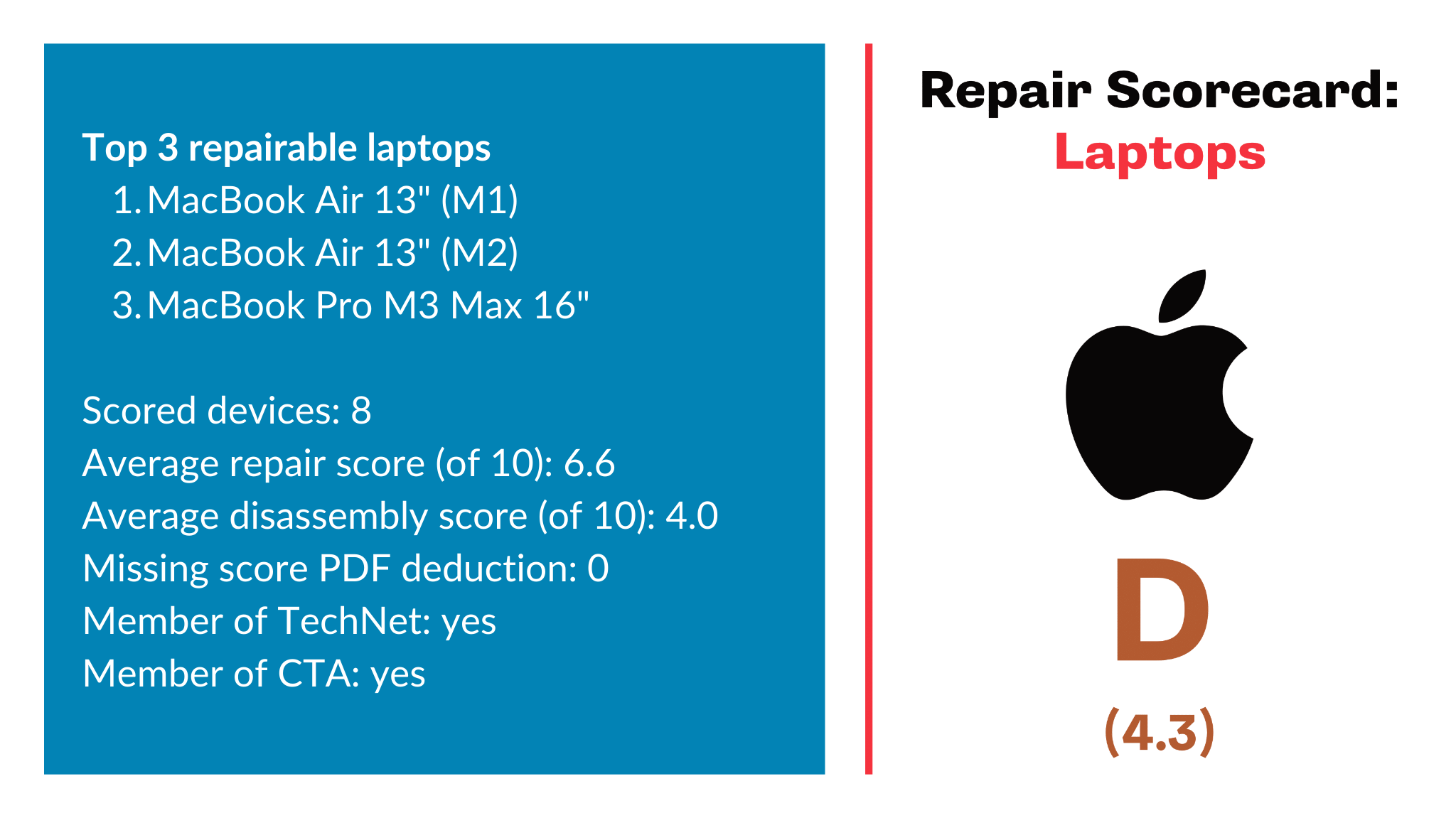

Apple is still in last place in terms of laptop manufacturers, but the iPhone maker improved the most in terms of cellphones. That’s because Apple has improved the ability to take apart and fix their phones. Overall, scores have increased for cellphones from all manufactures indicating that repair scores are continuing to incentivize manufacturers to design more repairable products. - Newer laptops are failing the fix.

Unfortunately, improvement has not been consistent across product categories, with laptops having fallen according to several of our measurements. - Chromebooks are still less repairable than other laptops.

While advocates have successfully pushed Google to extend the lifespan of short-lived Chromebooks, the overall the average repair score across Chromebooks from all manufacturers was lower than for all other laptops. This was also true for the disassembly category which we identify as the most important in our analysis. Both of these lower averages indicate that while often considered an affordable choice for individuals or schools, Chromebooks are on average less repairable than other laptops. - 8 out of 10 companies are part of anti-Right to Repair trade associations.

Requiring companies to provide access to parts and service instructions, as well as any necessary software tools, would improve repair scores across the board, and result in more products getting fixed, avoiding electronic waste. Most companies are still part of associations such as TechNet and the Consumer Technology Association that fight against the Right to Repair. - American consumers want Right to Repair scores to help them choose fixable products.

We don’t know which products are designed to last before we buy them. Right to Repair scores, similar to the scoring system used by this report, provides transparency in the marketplace by providing consumers with a simple way to compare repairability across products. These scores are like car fuel economy stickers for repairability. Colorado recently passed a resolution calling for national Right to Repair Scores.

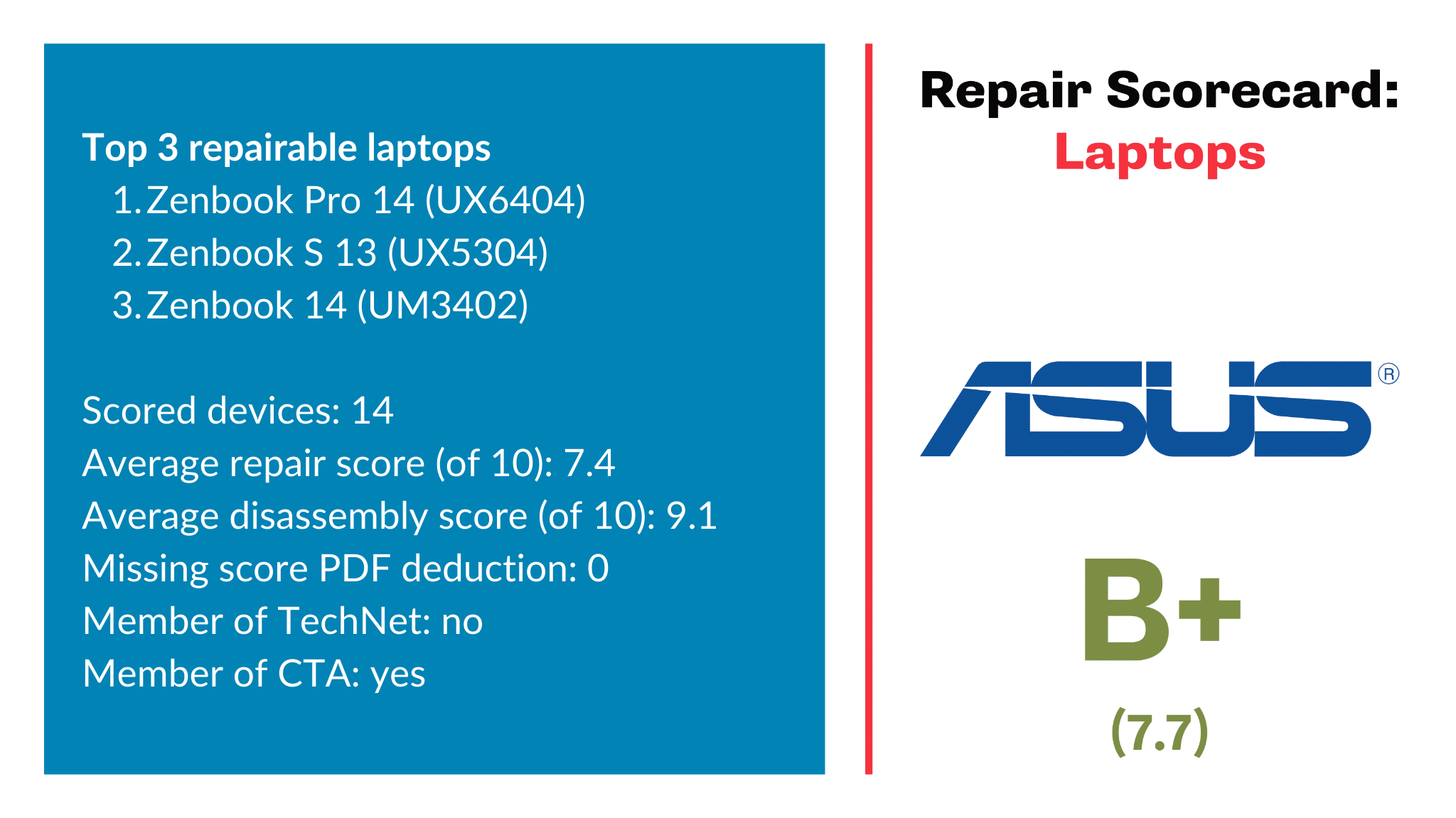

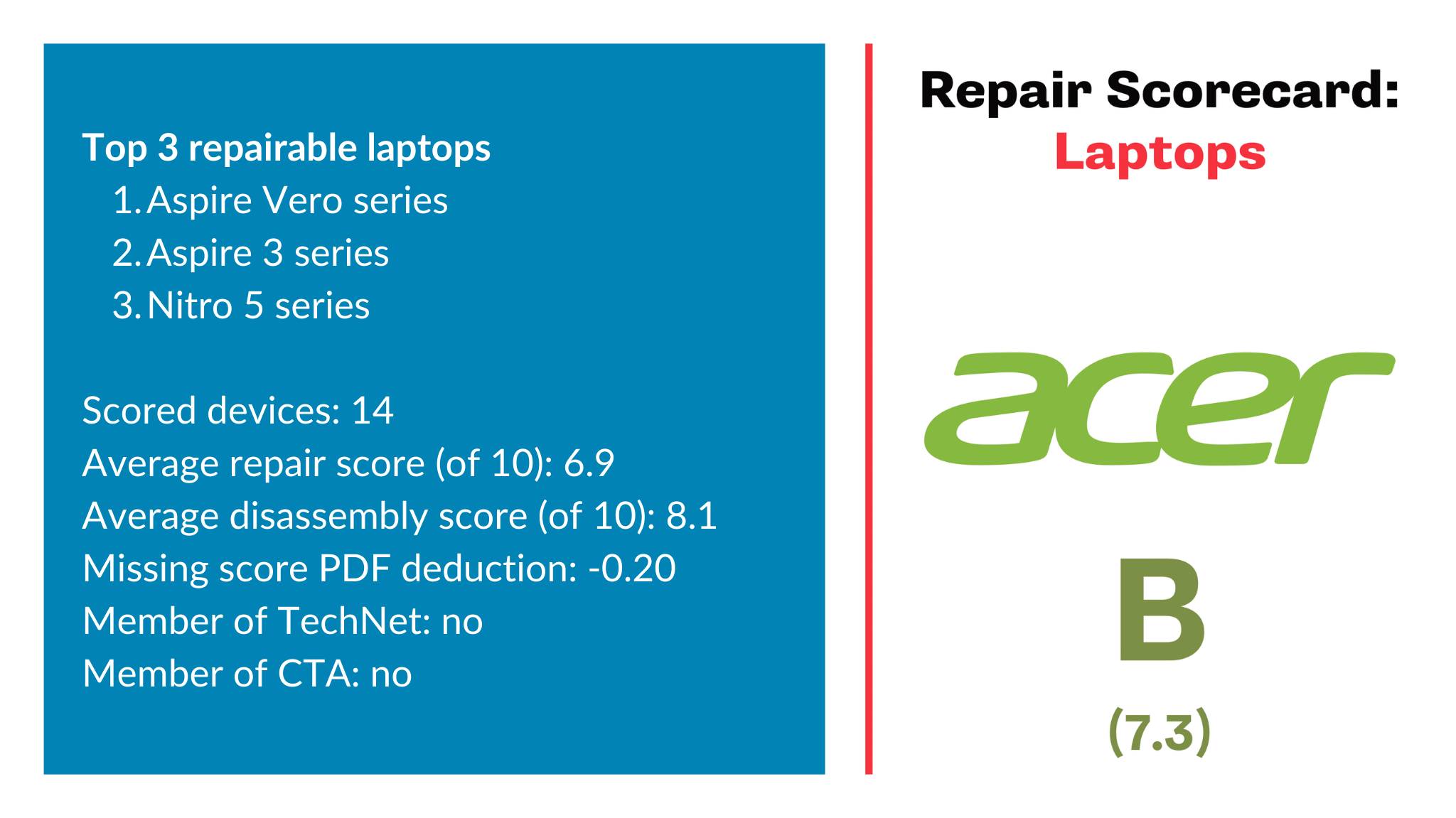

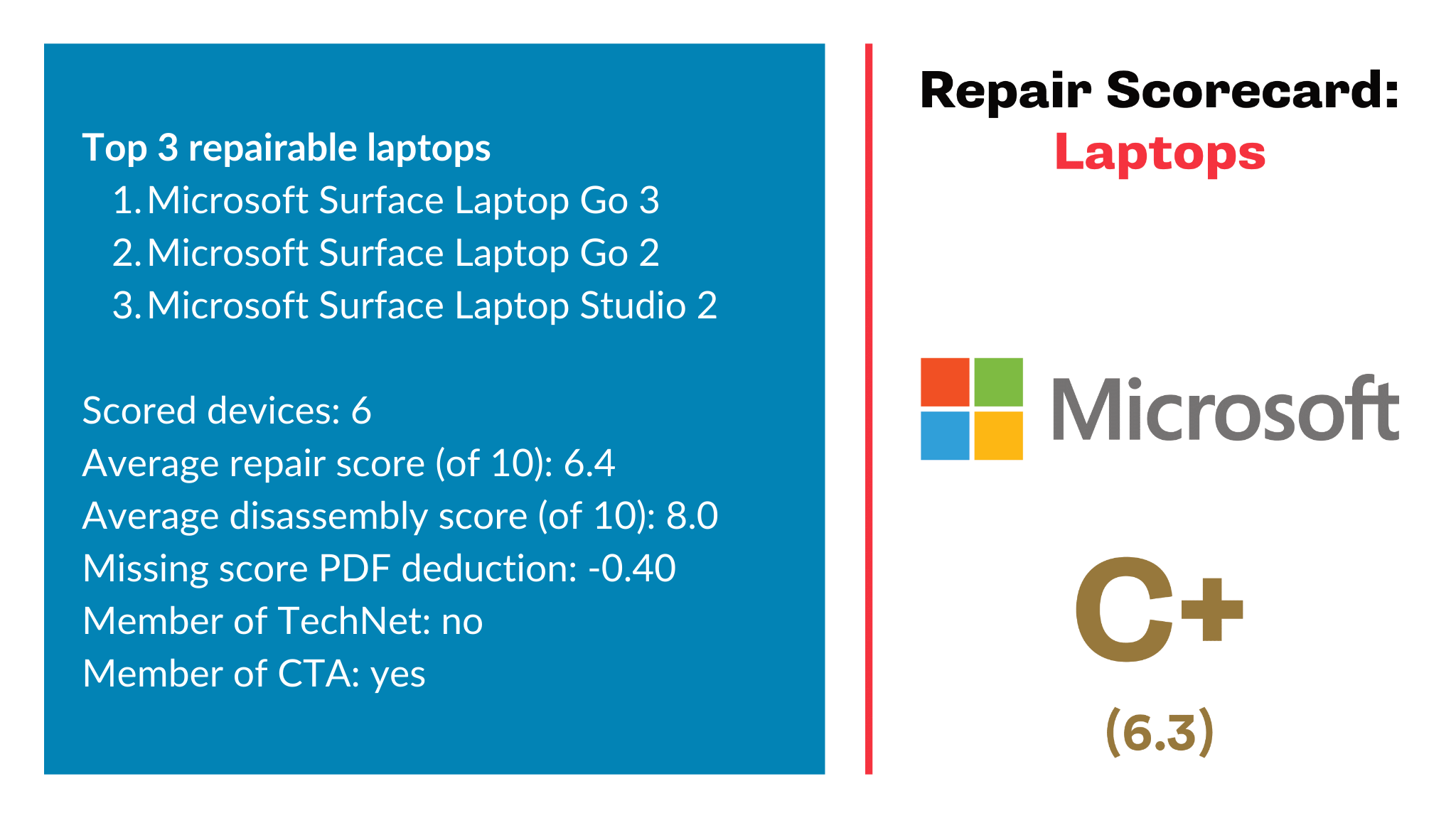

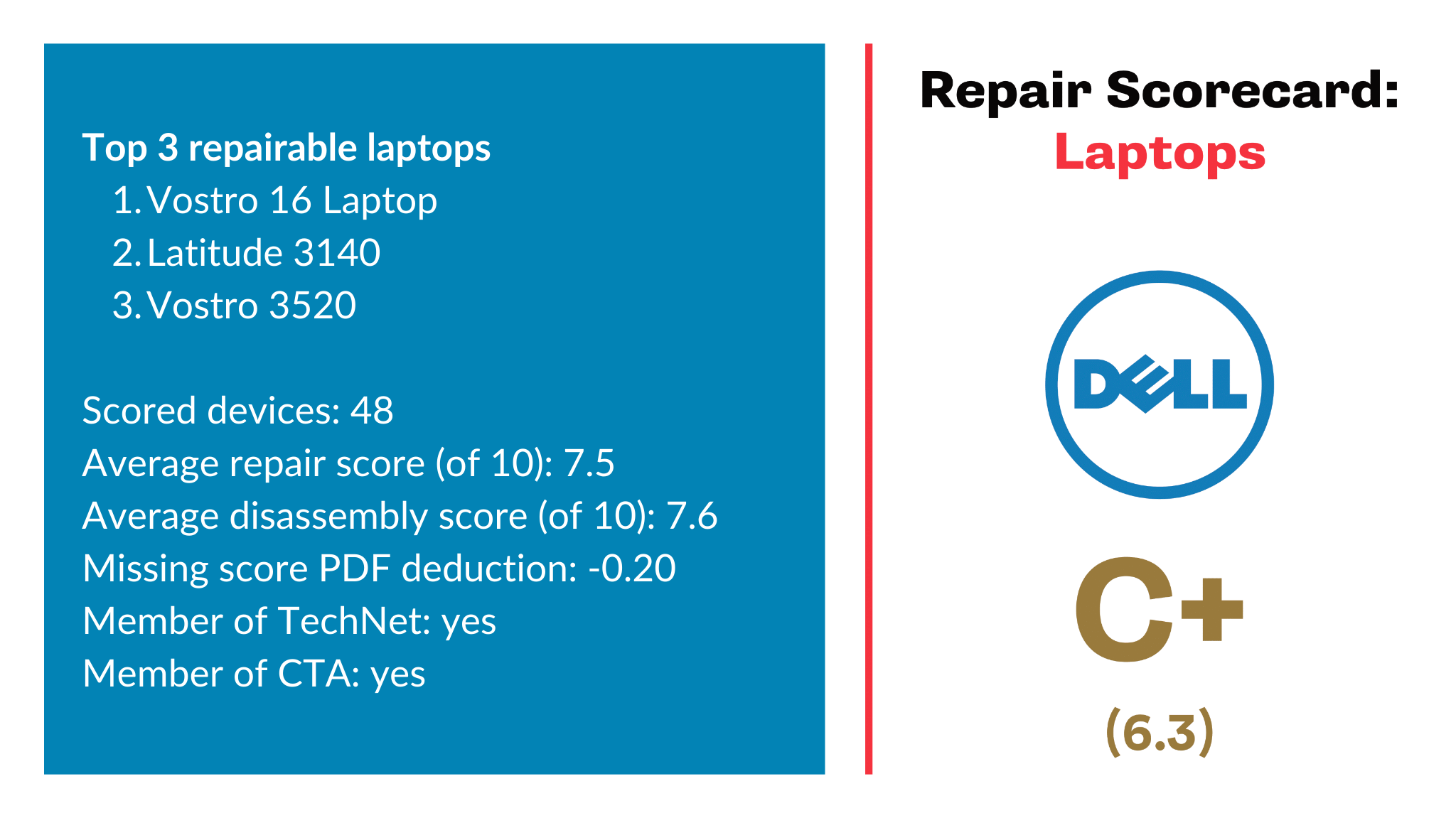

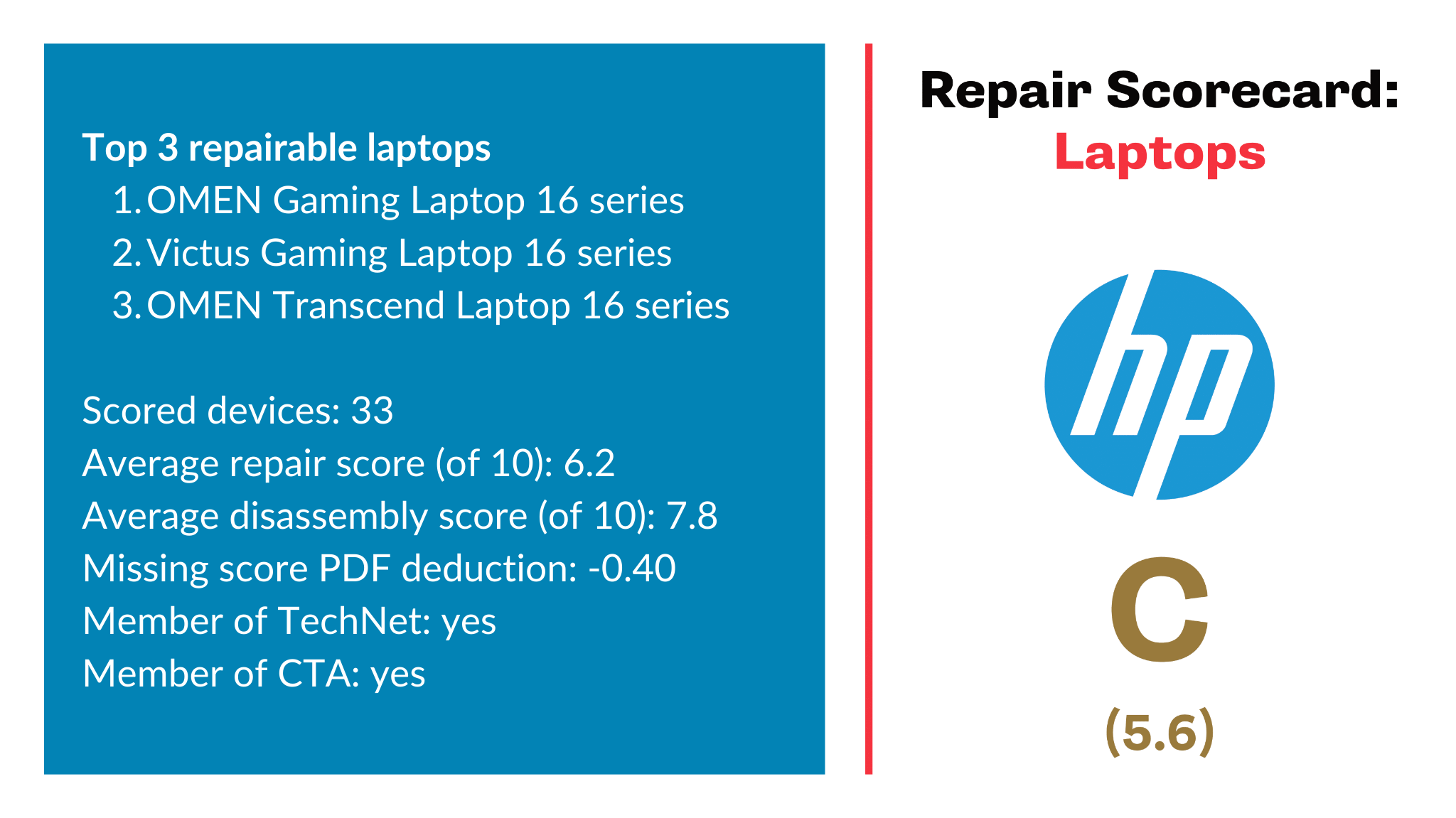

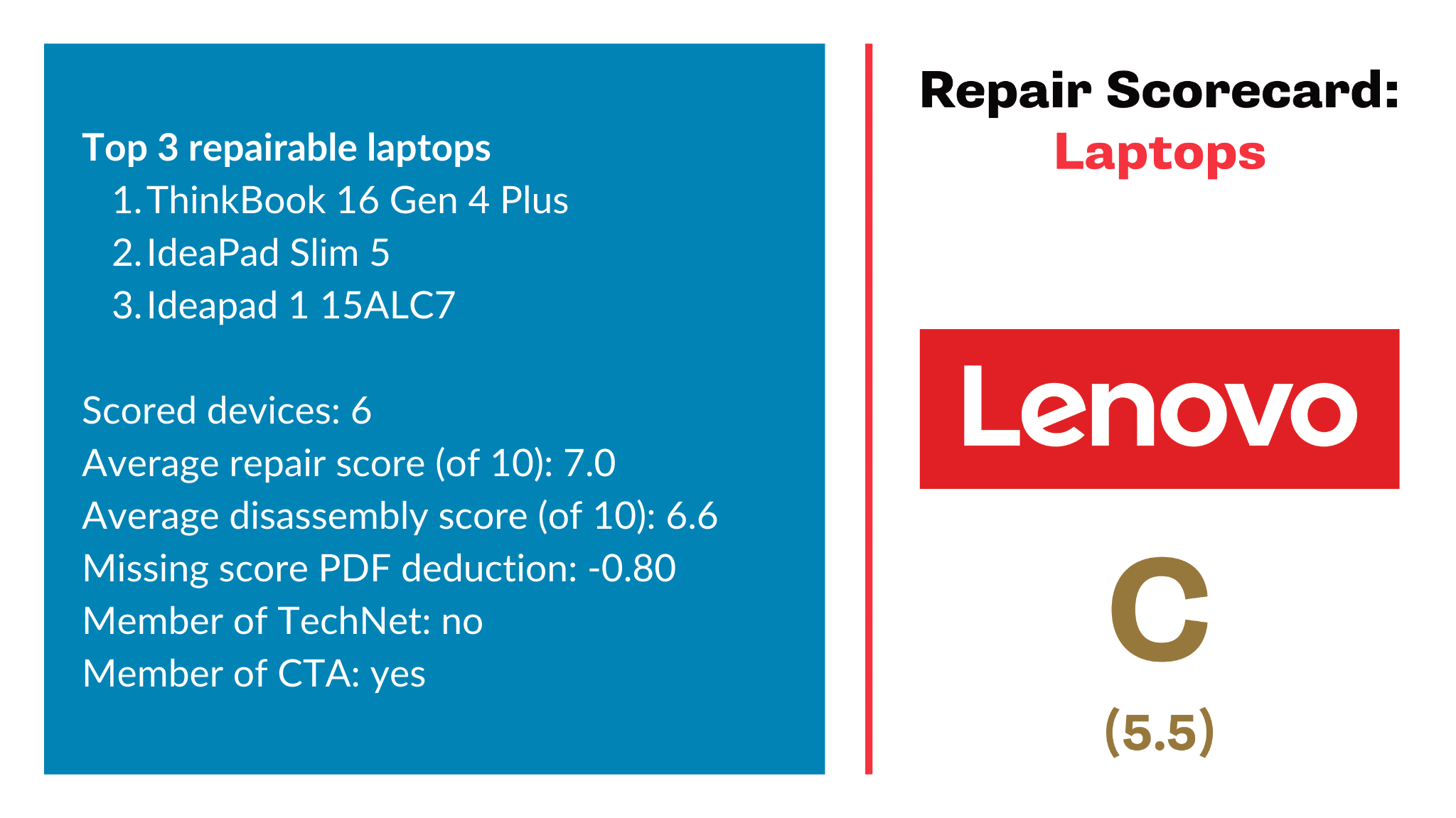

Motorola leads cell phone manufacturers with a C+, while Apple and Google are tied for second place, each earning a C. Samsung lags with a C-. For laptop manufacturers, ASUS leads in repairability with a B+, followed by Acer with a B, DELL and Microsoft are tied for third each scoring a C+ grade, HP and Lenovo follow each earning a C, and Apple is in last place with a D.

Why does this matter?

You have a right to know if the expensive tech you buy is fixable, especially because, unlike the old saying, you don’t always get what you pay for — at least when it comes to repairability. You should be able to buy products that will last, be repairable when they break, and are made by companies that respect your Right to Repair.

- It saves the environment

The prevalence of unfixable stuff is a mounting problem for both consumers and the planet. The Environmental Protection Agency reports that electronic waste is now the fastest growing part of our domestic municipal waste stream. - It saves you money

An earlier PIRG report found Americans could save a combined $40 billion a year if we were able to repair instead of replacing our products.

How are the grades calculated?

Since January of 2021, France has required companies to provide detailed information about how fixable certain products are, and to post an overall repair score at the point of sale, much like U.S. car fuel economy sticks. Our third edition of “Failing the Fix” reviews the detailed repair information for 164 devices and tracks changes in grades since our last report. This year’s edition also includes a section highlighting the three most repairable cell phones and laptops available on the market from each manufacturer to guide consumers looking to buy a fixable device.

To calculate a final grade we start with the five categories from France’s repair scores. We more heavily weights the disassembly score because we think this better reflects what consumers think a repairability score indicates and because the other categories can be country specific. Consumers’ ability to fix their devices is limited by efforts to stop the Right to Repair, so our final grades remove points from companies who are members of trade groups which lobby against repair legislation. This year’s addition also deducts points if manufacturers don’t easily provide full information on how they calculated their products’ repair scores.

Here’s the breakdown:

- Documentation: Does the manufacturer provide free service manual information to consumers?

- Disassembly: How easy is it to open and repair the device? Our grade weighs this score more heavily than the others because of its importance.

- Parts availability: Is it easy to find replacement parts?

- Parts pricing: Are spare parts affordable?

- Device-specific category: Several factors that are specific to laptop or phone repairability such as the availability of software updates.

- Membership in trade associations which lobby against the Right to Repair: We remove points if the manufacturer is a member of trade organizations that lobby against the Right to Repair such as TechNet or Consumer Technology Association (CTA).

- Missing scores deduction: We deduct points if manufacturers don’t provide full information on how they calculated their products’ repair scores. Lenovo was the worst at providing complete scoring information with 19 devices that were missing full scoring breakdowns or 76% of the total devices available for sale in France that didn’t have scoring information. When we called Lenovo customer service we were told that the devices were too new and the repair scores would be provided at an unspecified date.

What do we recommend?

Cellphones are improving but laptops are failing the fix. Consumers should choose products from manufactures with the highest fixability grades, and can review the top three most repairable devices from each brand to help them make the right choice.

Repair scores like this provide important information for consumers so they can make the best purchasing choices for their budget. It’s ridiculous to spend hundreds of dollars on expensive tech which is disposable.

The Right to Repair coalition, which includes PIRG, iFixit and Repair.org, has been calling for better access to the parts, tools and information needed to repair modern devices. We’re also advocating for Right to Repair scores to help consumers know which products are fixable before they make an expensive purchase.

Manufacturers should design products that are easier to open up and repair as well as not join trade associations that lobby against the right to repair to improve their scores. Retailers can voluntarily display Right to Repair scores that already exist to provide market transparency. Lawmakers can help by restoring our Right to Repair to ensure that we can fix our stuff, and requiring repair scores so we know which products are designed to last.

Topics

Author

Lucas Gutterman

Director, Designed to Last Campaign, U.S. PIRG Education Fund

Lucas leads PIRG’s Designed to Last campaign, fighting against obsolescence and e-waste and winning concrete policy changes that extend electronic consumer product lifespans and hold manufacturers accountable for forcing upgrades or disposal.

Find Out More

Fixed for the Holidays

Green schools guide

‘Chromebook Churn’ report highlights problems of short-lived laptops in schools